Business Foundation

Governance

- Overview of corporate governance

- Global Executive Committee (Global ExCo)

- Characteristics of the Board of Directors/Evaluating the effectiveness of the Board of Directors

- About the three committees

- Governance that continues to lead and support the realization of our Purpose

- Oversight structure/Executive structure

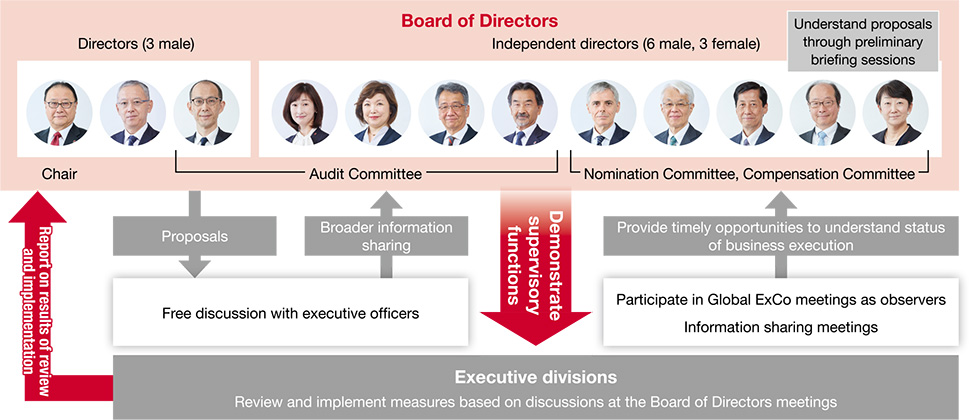

Characteristics of the Board of Directors

Function and Role of the Board of Directors

The Board of Directors fulfills its responsibilities as stipulated by laws and regulations and the Articles of Incorporation. It also makes decisions on important business matters as set forth in the Rules of Board of Directors, whilst also aiming to exercise its supervisory function regarding business execution.

To guarantee the effectiveness of oversight, the Board has a majority of independent directors, and to ensure a considerable degree of diversity among its members, gender, nationality, and other factors are also taken into consideration. The governance structure is designed to enhance transparency and fairness by appointing company managers, academics, and those with specialized knowledge of law, finance, and accounting.

Efforts to ensure and improve the effectiveness of the Board of Directors

A virtuous cycle created by demonstrating the supervisory function of the Board of Directors

All directors, including the chairman, are acutely aware of the need to guarantee and improve the effectiveness of the Board. We have established a cycle of constantly engaging in discussions and utilizing opinions to share timely and appropriate information about the Company’s business over the course of the year with the following specific initiatives.

1. Preliminary briefing sessions for the Board of Directors

In order to ensure that the discussions of the Board of Directors are constructive and productive, preliminary briefing sessions are held for all outside directors before every meeting of the Board. During the Board meetings, discussions are informed by the opinions and questions raised at these sessions. Integrating preliminary briefings and Board meetings in this way allows for discussions to be both efficient and substantial, and ensures that the knowledge and perspectives of outside directors are also directly reflected in how the Board operates.

2. Giving scope to the supervisory function of the Board of Directors

We actively undertake initiatives that help the Board demonstrate its supervisory function, such as by strengthening information sharing so that the directors can better understand how business is being executed. This ensures sufficient communication is maintained without creating a sense of distance between the Board of Directors and the executive divisions.

| Specific initiatives |

|---|

etc. |

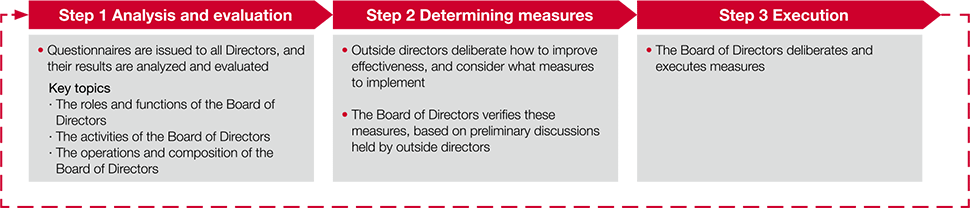

Evaluating the effectiveness of the Board of Directors

Improving the effectiveness of the Board of Directors through PDCA cycles

As part of its efforts to improve the effectiveness of the Board of Directors, every year the Company issues a questionnaire, which includes a self-evaluation section, to each Director. We use the results of these questionnaires to analyze and evaluate the effectiveness of the Board of Directors as a whole. We also work to improve the functionality of the Board of Directors, and strengthen corporate governance. To this end, we actively incorporate the the opinions of Directors, verify measures for any identified issues and for the further evolution of the Company, and carry out PDCA cycles for the execution of concrete initiatives that enhance the functionality of the Board of Directors.

PDCA cycles to improve the effectiveness of the Board of Directors

| Main assessments of FY2022 initiatives |

|

|---|---|

| Initiatives in Fiscal 2023 | The following are the topics that the Company’s directors believe management ought to start or continue, discussing in more depth, as well as initiatives that might be effective in enabling the Board to function better. The Company will bear these items in mind and continue to take measures to enhance the Board’s effectiveness. Topics that ought to be discussed in more depth by management:

Key initiatives to enable the Board of Directors to function better

|