Strategy/Capital

A Message from the Group CFO/CSO

By allocation of management resource for a establishment of the resilient business portfolio and sustainable growth, we are aiming for the realization of SOMPO’s Purpose and development of its corporate value.

Masahiro Hamada

Group CFO/Group CSO

The external environment in which we operate just seems like VUCA where the future is unpredictable. New social challenges became apparent while customer values and needs have changed dramatically. SOMPO’s Purpose is to “create a society in which every person can live a healthy, prosperous and happy life in one’s own way with a Theme Park for Security, Health & Wellbeing” which lies at the core of business management. My mission as the Group CFO and CSO is to fulfill SOMPO’s Purpose and enhance enterprise value by building a resilient business portfolio to adapt to such changes in the business environment, and balancing “defensive” initiatives, such as ensuring financial soundness, and “offensive” initiatives, such as allocating resources to ensure the Group’s sustainable growth even in the age of VUCA.

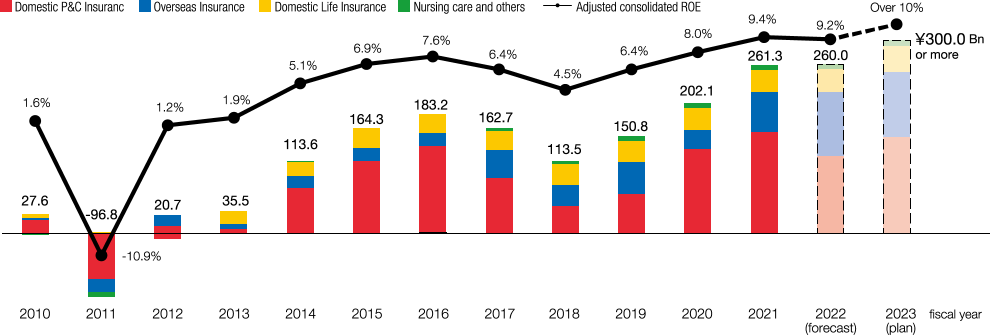

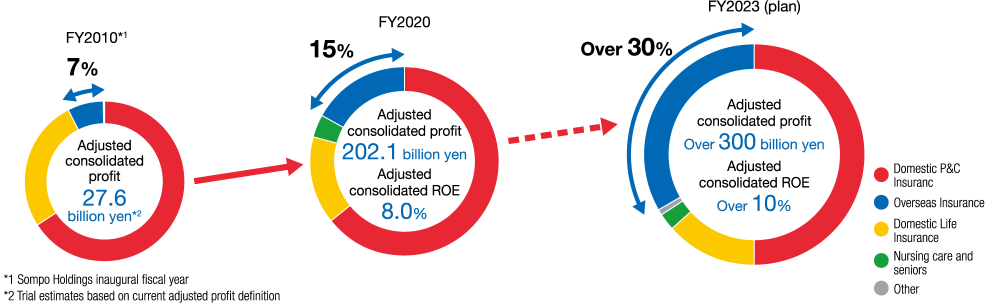

When I reflect on the ten years since NKSJ Holdings, Inc. (current Sompo Holdings, Inc.) was founded in 2010, we have successfully and dramatically transformed the revenue base and business portfolio. First, the two domestic P&C insurance subsidiaries, our core business, were gradually integrated and made more profitable, and as a result of the merger in September 2014, a core Group company and one of the largest P&C insurer in Japan was created. Sompo Japan Insurance Inc. which generates stable cash flow and has a solid business foundation, reviewed its pricing strategy, dramatically improved profitability through earnings structure reform, such as productivity improvement by utilizing digital technologies, and continues to evolve. We also expanded the overseas insurance business to address challenges, such as Japan’s population decline, low birthrate and population aging, and natural disasters, and to increase geographical and risk diversification of the business portfolio with too much weight on domestic P&C insurance, entered into the nursing care business, and worked aggressively on the utilization of digital technologies. In the overseas insurance business, we expanded into fast-growing emerging countries, including Turkey, Malaysia, and Brazil, and successfully completed large M&As in developed countries, including UK-based Canopius Group in 2014 and Bermuda-based Endurance Specialty Holdings Ltd. (current Sompo International Holdings Ltd.) in 2017, to expand into specialty insurance, etc. where higher profits and growth were expected, and the business size increased by leaps and bounds. We also built a global platform by reorganizing subsidiaries in the overseas insurance business and established a robust business foundation by enhancing governance. In other business areas, we made a full entry into the nursing care business in FY2015, implemented a series of measures to improve service quality and productivity, and materially expanded the fields where SOMPO delivers value. Furthermore, we worked on creating new businesses, including the establishment of “SOMPO Digital Lab” in Tokyo, Silicon Valley, and Tel Aviv as one of the early adopters of digital technologies in Japan, and steady enhancement of framework as a data solution provider by partnering with U.S.-based Palantir Technologies Inc. that has the best data analytics capability in the world. We diversified and ensured stability of the revenue base by honing our competitive edge in each business while allocating resources boldly across the group. As a result, adjusted consolidated profit increased from JPY27.6 billion in FY2010 to JPY202.1 billion in FY2020, the highest ever at that time, while adjusted consolidated ROE rose from 1.6% in FY2010 to 8.0% in FY2020 as big advances were made. In just 10 years since founding, Sompo Holdings accomplished such transformation, strengthened business foundation, accumulated capital, and paved the way for the group to grow substantially and accelerate the realization of “A Theme Park for Security, Health & Wellbeing.”

To continue on the growth path in the 2010s, we are working on the current Mid-Term Management Plan (FY2021-2023) to realize further growth of Sompo Group in the 2020s.

In developing the plan, I mulled over the megatrends in the next 10 years as the Group CSO. Globally, new risks are emerging due to climate change, advances in digital technologies, and social change, and a new normal society is being formed as a result of divided society, inflation, rising geopolitical risk, etc. while Japan faces social challenges due to population decline, low birthrate and population aging ahead of other countries. Social change and future challenges were brought forward due to the spread of COVID-19 and uncertainty is rising.

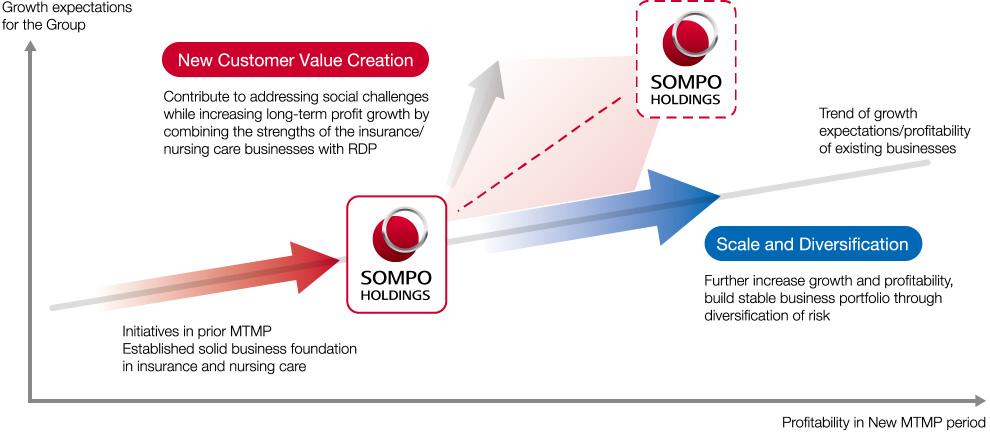

In such environment, three core strategies to focus on were developed. And we are working on “scale and diversification” being aware of the importance of preparedness against uncertainties and resilience more than ever as insurance is the founding business, “new customer value creation” by addressing social challenges across boundaries of insurance, and “new work style” that underpin all challenges.

We set specific KGIs and KPIs for each core strategy and have made good progress toward achievement. On “scale and diversification,” we aim to generate adjusted consolidated profit of JPY300 billion or more with adjusted consolidated ROE of 10% or higher by establishing a stable revenue base comparable to global peers, enhance capital efficiency, stability, and growth to build resilience as well as sufficient geographical and risk diversification driven by further improvement in the profitability of the domestic P&C insurance business and growth of the overseas insurance business. On “new customer value creation,” we decided to focus on the Real Data Platform (RDP) that utilizes vast amount of real data obtained in the insurance and nursing care businesses, etc. as a key tactic to fulfill our purpose of realizing “A Theme Park for Security, Health & Wellbeing.” We aim to address social challenges and develop business models that can be monetized by delivering RDP solutions. The development of the RDP is at the most advanced stage in the nursing care business and new services will be announced in the near future. On “new work style,” various measures are being implemented so that each and every employee is motivated by My Purpose, satisfied and happy at work, and achieves unparalleled productivity toward delivering SOMPO’s Purpose.

In executing the core strategies, we will aggressively invest for growth by using capital of around JPY600 billion over the current Mid-Term Management Plan period. This is to ensure that the goals of the Mid-Term Management Plan are achieved through investment in M&A and organic growth of primarily the overseas insurance business for “scale and diversification” and investment in digital and advanced technologies mainly in the RDP for “new customer value creation.”

As the Group CFO, I would like to explain the three core strategies from a financial perspective. I believe that the execution of three core strategies will lead to enterprise value enhancement through improvement in stock valuation, including the P/B ratio. As you know, the P/B ratio is obtained by multiplying the ROE by the P/E ratio. The ROE has the largest impact in improving stock valuation. So we will work on “scale and diversification” mainly in the core insurance business, generate large cash flows from small capital, and increase ROE steadily at both the individual business and group level. Specifically, we will reduce strategic shareholding, interest rate risk, etc. and invest the proceeds in capital efficient business and domains. However, in reality, it is difficult to increase the ROE to, for example, 30% since certain levels of capital must be maintained in the insurance business according to the regulations of each country. Therefore, it is important to increase the P/E ratio in addition to the ROE to increase enterprise value. Growth expectations, including unrealized financial value, and profit stability are closely related to the P/E ratio. We aim to increase the P/E ratio by generating stable cash flow through “scale and diversification” driven by the growth of the insurance business as well as raising growth expectations in non-insurance areas, such as through investment in human capital for “new customer value creation” and “new workstyle,” and eventually increase stock valuation and enterprise value which still have room for improvement.

We are also more aware than before through valuation analysis that shareholder return influences stock price and that dividend increases are especially important. Under the current Mid-Term Management Plan, 50% of adjusted consolidated profit will be returned as basic return, and we plan to steadily increase the total shareholder return through profit growth, and increase the ratio of dividends to total shareholder return. We will also deliver supplemental return depending on financial performance and capital situation. In FY2021, we decided to return JPY150.7 billion to shareholders, the highest level ever, including supplemental return of JPY20 billion based on interim results, in light of the strong financial performance. In FY2022, dividends are expected to increase by JPY50 to JPY260 per share (interim: JPY130, final: JPY130) based on profit growth outlook, representing DPS growth for nine consecutive years.

We made a good start toward achieving management targets in FY2021, the first year of the current Mid-Term Management Plan. While there were positive surprises considered to be one-off, such as fewer traffic accidents due to the spread of COVID-19 and larger investment profit owing to strong financial market environment, adjusted consolidated profit reached JPY261.3 billion, a record high of for the second consecutive year and adjusted consolidated ROE was 9.4% owing to solid underlying business performance, including the progress of earnings structure reform in the domestic P&C insurance business and stronger-than-expected top line growth in the overseas insurance business. In the remaining FY2022 and FY2023, we will further accelerate initiatives in existing businesses, invest for growth, step up DX, and work on creating a conglomerate premium to increase the probability of achieving adjusted consolidated profit of JPY300 billion or more and adjusted conglomerated ROE of 10% or higher, the management targets for FY2023, the final year of the Mid-Term Management Plan.

SOMPO will allocate resources, invest for growth, and deliver attractive shareholder return along with profit growth to deliver social value driven by purpose and continue to enhance enterprise value. Please stay tuned to future growth of Sompo Group.