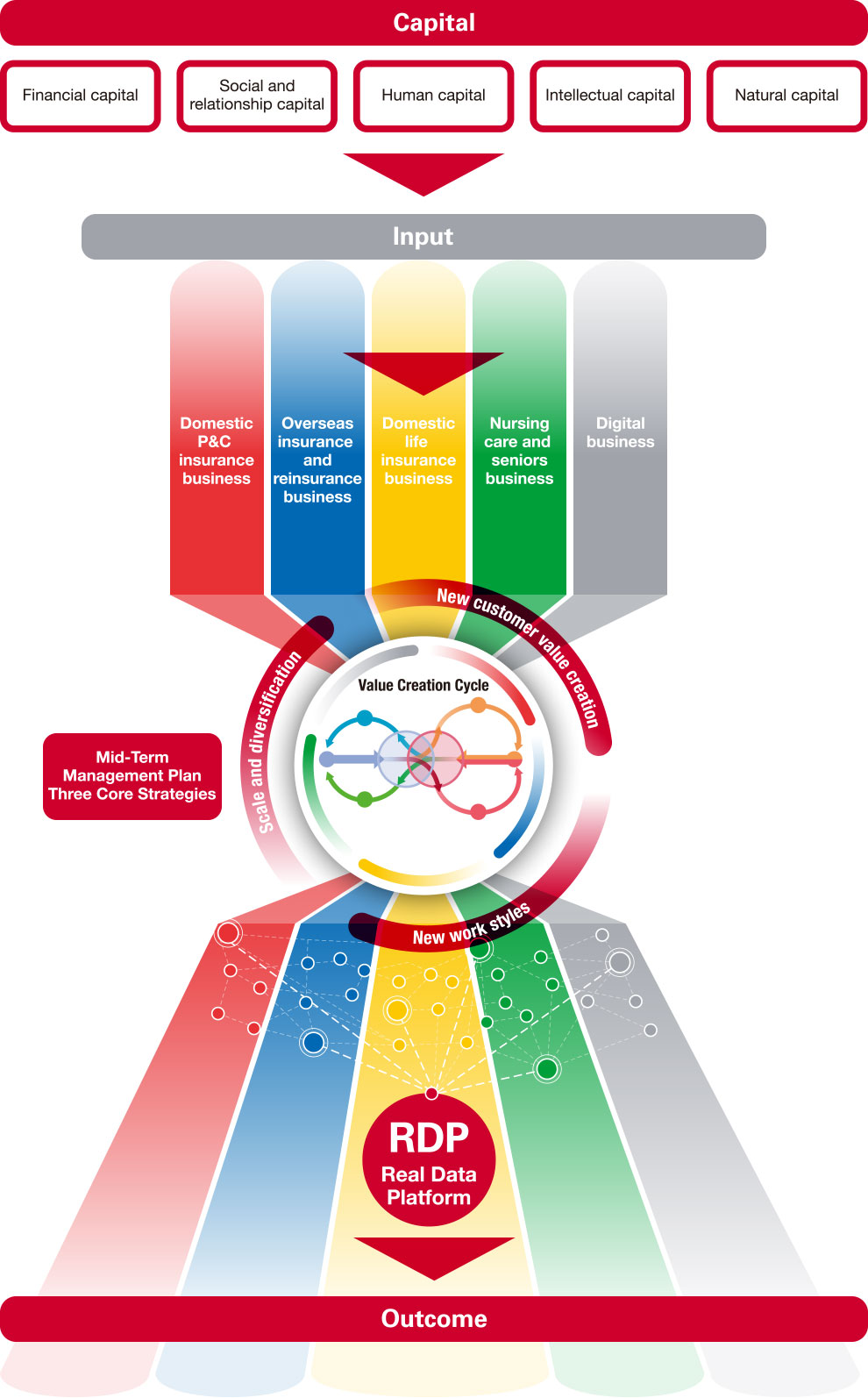

Strategy/Capital

Over our 130-year history, we have accumulated numerous capital assets that serve as the source of ourcompetitiveness.

We will combine our stable revenue base and diverse capital built on relationships of trust with a variety of stakeholders to create value that only SOMPO can offer. Our 74,000 employees, each motivated by their own My Purpose, are the driving force for our Value Creation Cycle, which we are using to achieve sustainable growth and realize SOMPO’s Purpose.

* Actual figures for FY 2021 unless otherwise noted

Click here for capital details

SOMPO’s Capital as a Source of Competitiveness : Capital(PDF/543KB)

Ability to generate cash flow, mainly from domestic P&C insurance, enabling the Group to make growth investments

Gross revenue: ¥3,677.5 billion

Sound financial base and ample room for growth

Adjusted consolidated net assets: ¥2,824.8 billion

Trust and responsibility cultivated through our 130-year history

Customer base of roughly 20 million

Networking with diverse stakeholders

<Leading examples of collaboration>

Palantir; Tier IV, Inc.; National Institute of Advanced Industrial Science and Technology; Institute for Advanced Biosciences, Keio University; and others

<Participation in international initiatives>

Partnership for Carbon Accounting Financials (PCAF), the Net Zero Alliance under the Glasgow Financial Alliance for Net Zero (GFANZ), and others

Group of people who share the three core values that are realized through new work styles

Digitally capable human resources to accelerate DX

A corporate culture unafraid of change

Environment enabling use of cutting-edge technologies

SOMPO Digital Lab: Global trilateral structure Future Care Lab in Japan: R&D on new nursing care

High-volume, high-quality real data accumulated from diverse lines of business

Advanced problem-solving ability for converting social issues into business opportunities

Achieved sustainable growth

Adjusted consolidated profit: ¥261.3 billion

Maintained and improved capital efficiency to meet shareholder

expectations

Adjusted consolidated ROE: 9.4%

Diversified to underpin earnings stability

Risk diversification ratio: 41.1%

Overseas business ratio: 23.7%

Made contributions to society in the form of infrastructure

that supports daily life

Net claims paid: ¥1,584.3 billion

Number of nursing care recipients: 90,000

Enhanced brand power: Brand value: US$605 million*

Increased presence through engagement in international initiatives

Attended 7 WEF annual meetings in Davos

*Based on a survey by Interbrand Japan, Inc.

Producing employees who are motivated by their My Purpose

Goal: Completion of My Purpose training by all eligible participants by FY2023

Result: 66% have undergone training for domestic P&C insurance, domestic life insurance, and nursing care & seniors business

Enhanced diversity of human resources as a source of innovation

Ratio of female employees in management positions: 26.8%

Improved employee job satisfaction and happiness

Goal: Achieve average Gallup Q12 target by FY2023

(Japan: 3.70 pts, Overseas: 4.10 pts)

Result: Japan: 3.46 pts, Overseas: 4.02 pts

Proactively invested in digital technology and leveraged industry-government-academia collaboration to deliver innovation

Enhanced our lineup of products and services that underpin

customers’ security, health, and wellbeing

Newly developed insurance products, riders, and services in FY2021: 46*

Reduced the burden of nursing care and contributed to a sustainable aging society

Goal: Introduce future nursing care models in 258 facilities by FY2023

*Simple aggregate of the number of newly developed products, services and riders released by Sompo Japan and Sompo Himawari Life in FY2021

Greenhouse gases (GHG) Reduction target

Scope 1/2/3 (Category 1–14)

2050: Net zero

Scope 3 (Category 15: Investments)

2050: Net zero