James Shea

CEO of Overseas Insurance and Reinsurance Business

Strategy

Further Strengthening Resilience

1) Scale and Diversification

Events that were unimaginable in the recent past are now occurring one after another, including natural disasters of increasing intensity, supply chain disruptions due to the COVID-19 pandemic, and higher-than-expected levels of inflation. In order to protect people from all kinds of risks in the face of this new normal, the Sompo Group has been striving to improve resilience by pursuing “Scale and Diversification” as a basic strategy in its Mid-Term Management Plan.

The pillars of the strategy are the expansion of global scale, the advancement of risk diversification, and the reform of the earnings structure in Japan. This part of the report describes the efforts of the two businesses that are driving these “Scale and Diversification” efforts: the Overseas Insurance and Reinsurance Business and the Domestic P&C Insurance Business.

Advancing “Scale and Diversification” Globally

Results so far

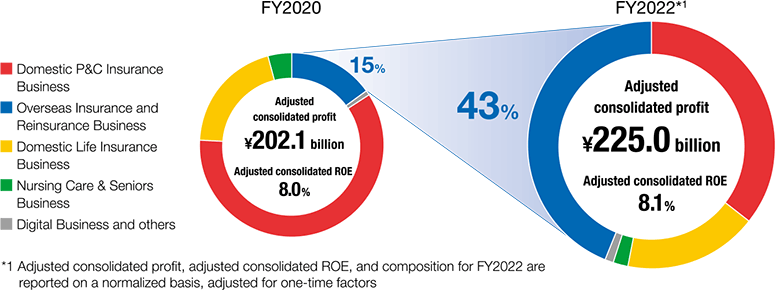

In line with the current Mid-Term Management Plan, which calls for “Scale and Diversification” as a strategy to increase profit stability by moving away from a business portfolio in which the Domestic P&C Insurance Business generates the majority of profits, we have been working on the allocation of management resources to the Overseas Insurance and Reinsurance Business. As a result, the Overseas Insurance and Reinsurance Business has grown significantly over the past two years. In FY2022, the Overseas Insurance and Reinsurance Business accounted for 43% of the Group’s total profits, reflecting progress in diversifying the Group’s business portfolio and improving its resilience.

Overseas Insurance and Reinsurance Business accounts for more Group profits (progress in business portfolio diversification)

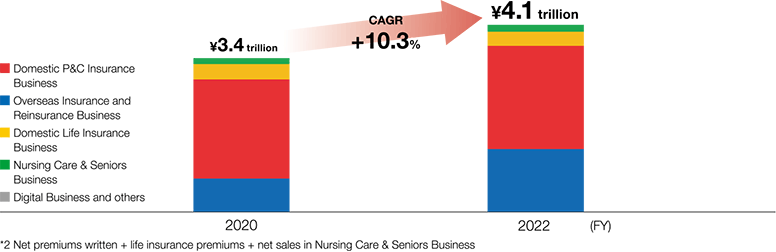

Expand scale by increasing premium income*2 of Overseas Insurance and Reinsurance Business

Achievements of Overseas Insurance and Reinsurance Business that led the Group

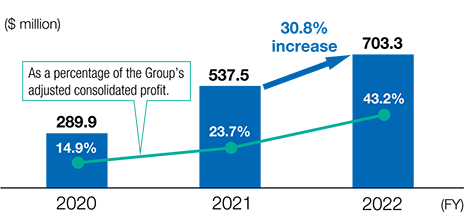

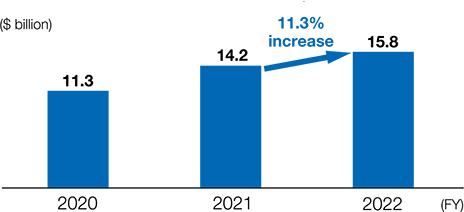

In FY2022, Sompo International continued to contribute strong growth in operating income with an adjusted profit of $703.3 million, up 30.8% from FY2021 and contributing materially to the overall profit to Sompo Group. This result was achieved despite significant CAT events across the industry and supported by a continued focus on exposure management, diversification of the portfolio and prioritizing underwriting discipline. The combined ratio across Sompo International commercial insurance was 93.5% with the accident year combined ratio improving 0.8 pts to 92.1% in the calendar year. Gross Premiums Written were $15.8 billion, 11.3% higher than in the previous year. The global commercial business expanded 9.9% as pricing trends remained positive and elevated commodity prices boosted agriculture insurance premiums. Both the commercial and consumer Insurance and reinsurance business segments contributed to this growth with the reinsurance portfolio surpassing $4 billion in Gross Premiums Written and a combined ratio of 90.1%. The consumer business also posted strong organic premium growth driven. Excluding the impact of foreign exchange and inflation in this market, the growth of the overall consumer business was double digit compared to the prior year.

* The percentage of Overseas Insurance and Reinsurance Business in the Group’s adjusted consolidated profit is calculated on a normalized basis excluding one-off effects.

Future actions

After delivering market leading results there are still opportunities for Sompo International to grow while continuing to support existing customers with a simplified and compelling product and service offering. Today, the insurance segment is heavily focused on business in the United States and United Kingdom. This provides an opportunity to expand into some of the other top 10 P&C markets globally as well as into new geographies within borders to participate in local and regional retail and Excess & Surplus markets. Selectively expanding the commercial insurance business into Canada, Continental Europe and Southeast Asia as well as delivering a broader commercial offering to our customers in Brazil will also be key drivers of growth. As the opportunities and market presents itself, we are ready to deploy more capacity to our reinsurance customers.

The introduction of the SOMPO brand to new customers and new markets along with geographic expansion and a sharp customer focus will position Sompo International to successfully deliver on commitments to the Sompo Group.

Comments from business owner

Over the past several years Sompo International has grown to be a leading provider of commercial insurance and reinsurance in our markets outside of Japan. With over 130 years of history servicing over one million commercial and consumer customers across the world and a global P&C business of $35 billion+ we believe it is time to focus on increased brand awareness and leveraging our size and financial strength to support existing and future customers on a level with other global P&C carriers.

A high performing successful organization attracts the best talent and creates a culture of empowerment. By delivering market-leading results, our organization will continue to giveback to society and the communities we operate in. We are excited about the future.

Earnings Structure Reform in Domestic P&C Business

Results so far

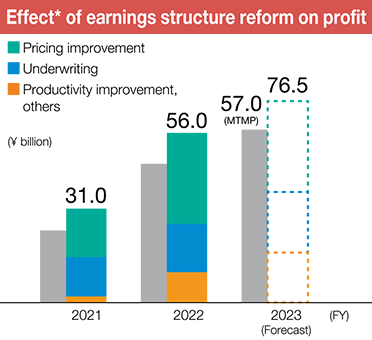

In order to continue fulfilling our mission of supporting the Security, Health & Wellbeing of our customers even in a rapidly changing environment, Sompo Japan Insurance has been working on earnings structure reform since fiscal 2019 under a three-pronged strategy of optimizing pricing, strengthening underwriting, and improving productivity.

As a result, in fiscal 2023, the final year of the current Mid-Term Management Plan, we expect an increase in profit of 76.5 billion yen, which exceeds the initial target and represents a solid contribution to resilience.

* The effects are estimated by comparing with FY2020 actual on an after tax basis

Specific measures

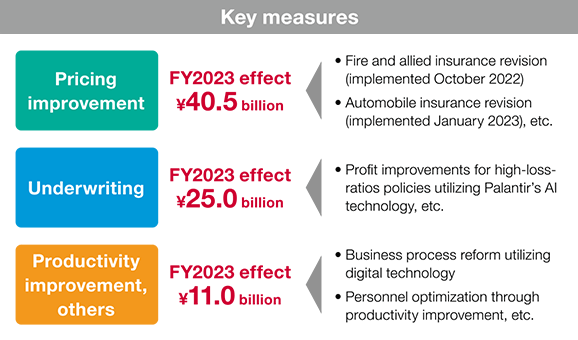

With regard to optimizing pricing, we have worked to improve profitability by revising the product details and premium setting in our mainstay fire and allied insurance and automobile insurance products.

In terms of underwriting, we are using Palantir’s AI underwriting to improve revenue from policies with high loss ratios.

With regard to productivity, we are improving productivity and optimizing our workforce by promoting business process reforms that leverage digital technology.

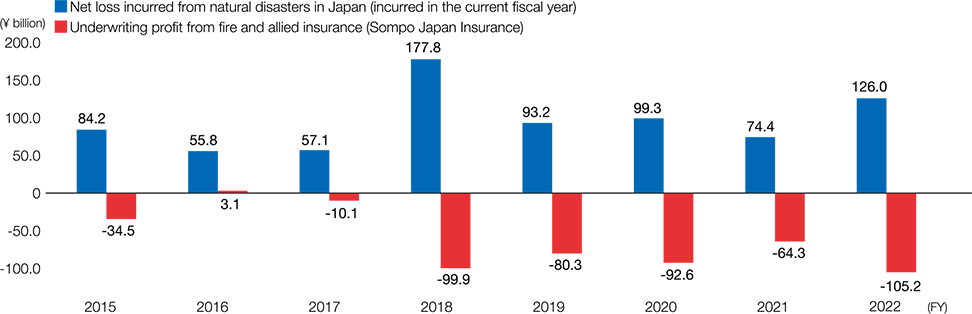

Although these efforts are steadily generating results, the business environment has deteriorated significantly in recent years due to the increase in the frequency of natural disasters and higher-than-expected inflation. We recognize that further improvement in profitability is necessary to sustainably fulfill our responsibilities as an insurance company in the future.

Future actions

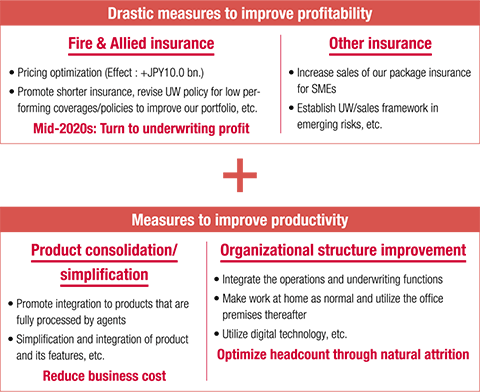

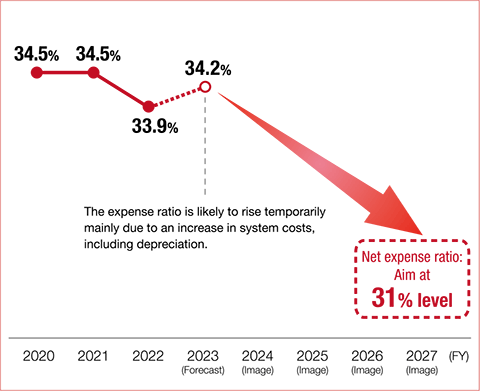

While steadily continuing the measures that have been implemented so far as earnings structure reform, such as pricing optimization and utilizing Palantir’s technology for underwriting, we will work on in-depth profit improvement measures and further productivity improvements, aiming to achieve an expense ratio of 31% in the medium to long term.

Improving the profitability of fire and allied insurance is an urgent issue, and we aim to make a profit by the mid-2020s.

Specific measures to achieve profitability will include a fundamental review of premium rates and implementing portfolio improvements by reviewing coverage for unprofitable policies.

We will accelerate efforts to improve profitability in light of changes in the business environment, including more frequent natural disasters and an increase in large losses.

*Sompo Japan Insurance (Excluding CALI & household earthquake)

Comments from business owner

Giichi Shirakawa

CEO of Domestic P&C Insurance Business

With regard to the earnings structure reform we are pursuing under the current Mid-Term Management Plan, steady progress is being made on our profit improvement measures utilizing Palantir’s digital technology, which is one of the Group’s advantages.

In addition, the positive feedback from our customers about our products and services has enabled us to achieve our target for net premiums written (excluding CALI and household earthquake) in fiscal 2022, one year ahead of schedule (the original target was for 2023, the final year of the Mid-Term Management Plan).

On the other hand, the business environment is undergoing major, non-transitory changes, such as more severe and frequent natural disasters, and the loss ratio, especially for fire and allied insurance, has remained high, putting pressure on profits.

Therefore, as a new action aimed at recovering profits, we will implement measures that go a step further than conventional measures. Specifically, in addition to reducing operating expenses through thorough productivity improvements, we plan to revise our rate levels in the next product revision based on the most recent earnings conditions and strengthen underwriting.

Our founding philosophy of “contributing to public welfare and the stability of people’s lives and industrial development” remains unchanged to this day. We will work to restore profitability in order to continue to provide fire and allied insurance, which is an established social infrastructure, as a sustainable insurance product.

2) One Sompo

In order to improve resilience, it is essential that each SOMPO business continues to improve its financial discipline, underwriting expertise, operational efficiency and market competitiveness. As we respond to the everchanging needs and risks of our customers, it is important that we leverage our expertise across the Sompo Group. In order for SOMPO to profitably grow and develop as a group, it will be necessary to enhance resilience by developing a capital efficient organization and deepening cooperation across the business units. With this mind, we launched the “One Sompo” project to create a collaborative and resilient business structure.

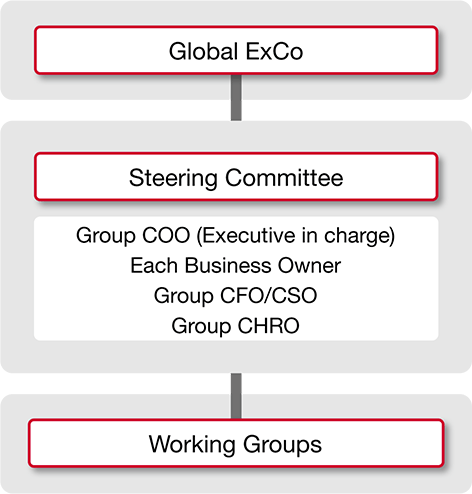

In order to connect the various businesses of the Sompo Group, we established a steering committee under the Global ExCO, the highest executive committee, and formed a project team with Group COO in charge, each business owner, Group CFO/CSO, and Group CHRO as members. We have been working on this project since FY2022.

Achievements in FY2022

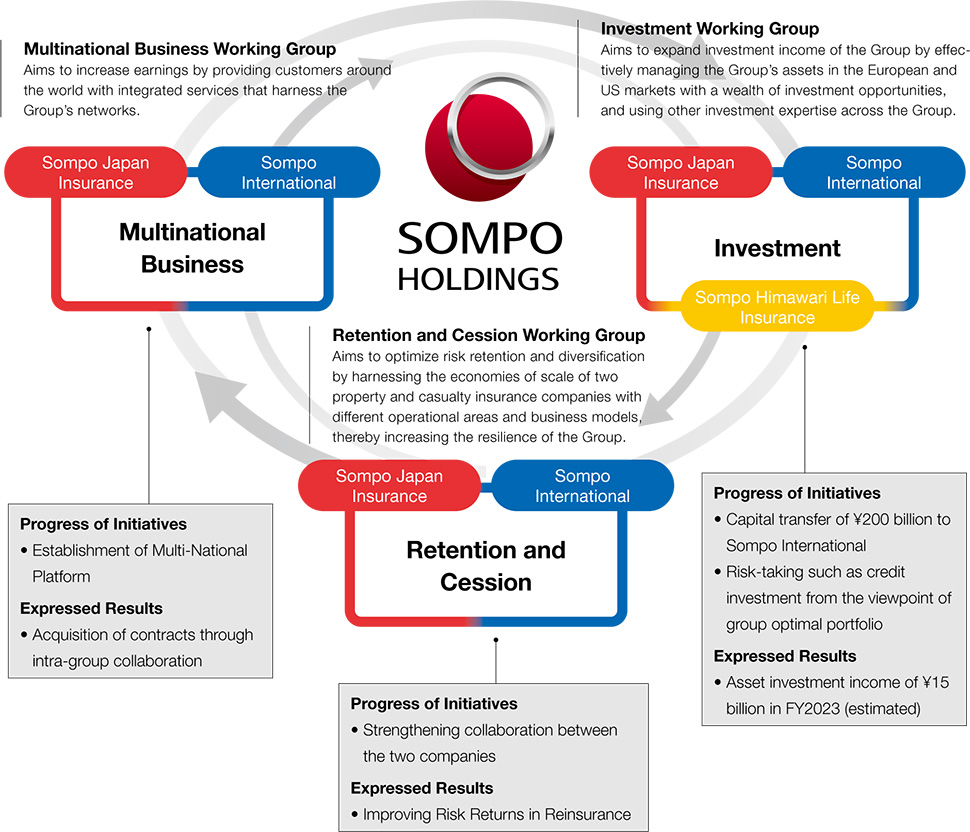

In FY2022, the Group established a working group under the three main themes of “Retention and Cession,” “Investment,” and “Multinational Business.” As a result, in FY2023, the Group worked to accelerate cooperation between Sompo Japan Insurance and Sompo International in the area of Retention and Cession, which led to improvement in Risk Returns.

In Investment, a capital transfer of ¥200 billion to Sompo International and diversification of operations are expected to generate an impact of ¥15 billion. In Multinational Business, Sompo Japan Insurance has established a platform and continues to acquire contracts through cooperation with Sompo International.

Toward the Post-Medium-term Management Plan

A new medium-term management plan is scheduled to start in FY2024, and we will work to improve the resilience of the Group even more than before and drive benefits by leveraging our strengths globally.