Strategy

Mid-Term Management Plan

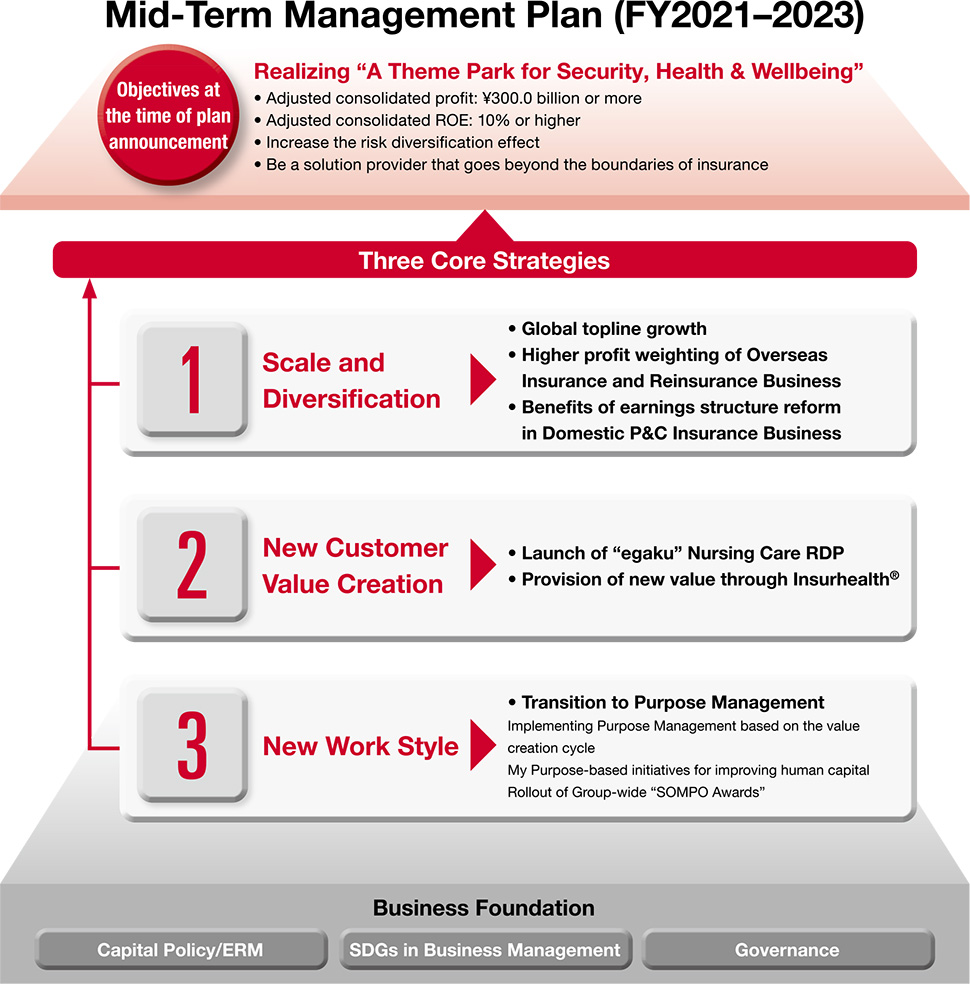

With the aim of achieving the SOMPO’s Purpose, we are currently implementing the three core strategies outlined in the Mid-Term Management Plan that kicked off in FY2021.

In addition to advancing our “Scale & Diversification” strategy sucha as chalking up topline growth of more than 10% annually and expanding the profit weighting of the Overseas Insurance and Reinsurance Business, we have also made steady progress on the core strategy of “New Customer Value Creation.” For example, we launched the “egaku” Nursing Care RDP project and acquired ND Software, a company that boasts the leading share of the nursing care software market.

For the “New Work Style,” we went about implementing what we call “Purpose Management” based on the My Purpose approach of each and every employee, and we undertook various initiatives aimed at improving human capital as the driving force of SOMPO’s Unique Value Creation.

For FY2023, the final year of the plan, even though we expect to reach our adjusted consolidated ROE target of at least 10%, we are forecasting adjusted consolidated profit of ¥280 billion, which mainly reflects the impacts of increasingly intense natural disasters, global price inflation, and the COVID-19 pandemic.

Taking the challenging external environment into account, we will continue to work towards generating further growth and achieving SOMPO’s Purpose by not only completing our current initiatives, but also by initiating and executing measures to boost profitability over the medium term.

Key Financial Performance Indicators

*Targets refer to the Mid-Term Management Plan announced in 2021.

| FY2020 actual | FY2021 actual | FY2022 actual | FY2023 forecast | Target (end-FY2023) | ||

|---|---|---|---|---|---|---|

| Adjusted consolidated profit | ¥202.1 billion | ¥261.3 billion | ¥152.2 billion | ¥280.0 billion | ¥300.0 billion or more | |

| Adjusted consolidated ROE | 8.0% | 9.4% | 5.5% | 10% or higher | 10% or higher | |

| Diversification effects | Risk diversification ratio | 39.4% | 41.1% | 39.5% | 40% or higher | Improvement on FY2020 |

| Overseas business ratio | 14.9% | 23.7% | 43.2%*1 | 50% or higher | 30% or higher | |

| FY2020 actual | FY2021 actual | FY2022 actual | FY2023 forecast | Target (end-FY2023) | |

|---|---|---|---|---|---|

| Adjusted profit | ¥130.1 billion | ¥157.4 billion | ¥32.0 billion | ¥80.0 billion | ¥150.0 billion or more |

| Net premiums written*2 | ¥1,903.4 billion | ¥1,941.7 billion | ¥2,014.7 billion | ¥2,047.4 billion | ¥2,000.0 billion |

| E/I combined ratio*2 | 94.3% | 93.5% | 100.9% | 97.3% | 91.7% |

| Reduction of strategic shareholdings | ¥70.3 billion | ¥50.1 billion | ¥70.3 billion | ¥70.0 billion | ¥50.0 billion (three-year total: ¥150.0 billion) |

| FY2020 actual | FY2021 actual | FY2022 actual | FY2023 forecast | Target (end-FY2023) | |

|---|---|---|---|---|---|

| Adjusted profit | ¥30.0 billion | ¥61.8 billion | ¥93.3 billion | ¥150.0 billion | ¥100.0 billion or more |

| GWP growth rate*3 | +37.8% | +31.1% | +9.9% | +10.6% | Annual rate of approx. +9% |

| E/I combined ratio*3 | 97.8% | 93.9% | 93.5% | 91.6% | 88–89% |

| FY2020 actual | FY2021 actual | FY2022 actual | FY2023 forecast | Target (end-FY2023) | |

|---|---|---|---|---|---|

| Adjusted profit | ¥32.5 billion*4 | ¥33.6 billion | ¥17.8 billion | ¥40.0 billion | ¥40.0 billion or more |

| Annualized new premiums*5 | ¥29.8 billion | ¥35.6 billion | ¥36.1 billion | ¥46.0 billion | ¥50.0 billion |

| Policies in force | 4.26 million | 4.45 million | 4.71 million | 5.00 million | 5.00 million |

| Investment for ALM matching*6 | — | ¥329.4 billion | ¥489.3 billion | ¥300.0 billion | ¥300.0 billion |

| FY2020 actual | FY2021 actual | FY2022 actual | FY2023 forecast | Target (end-FY2023) | |

|---|---|---|---|---|---|

| Adjusted profit | ¥7.3 billion | ¥5.9 billion | ¥5.9 billion | ¥7.0 billion | ¥8.0 billion or more |

| Revenue | ¥131.8 billion | ¥136.1 billion | ¥149.8 billion | ¥178.8 billion | ¥162.0 billion |

| Occupancy rate*7 | 89.4% | 91.1% | 92.3% | 94.8% | 93.8% |

| RDP | Nursing Care RDP “egaku” | ||||

| FY2023 target | Medium-to-long term target | FY2022 actual | FY2023 target | FY2030 target | FY2040 target |

|---|---|---|---|---|---|

| External sales and monetization of products and services that utilize RDP:Two businesses or more | Group revenue generated by the utilization of RDP: ¥500.0 billion or more | Decision on “egaku” launch | No. of facilities introducing “egaku” Nursing Care RDP: 100 | Operating income of “egaku” Nursing Care RDP: ¥10 billion | Social impacts that “egaku” Nursing Care RDP creates: ¥3.7 trillion (elimination of supply-demand gap of 220,000 people) |

*1 FY2022 overseas business ratio calculated using adjusted consolidated profit on a normalized basis to account for one-off factors *2 Sompo Japan Insurance (excl. CALI, household earthquake insurance) *3 Sompo International commercial business *4 Recalculated according to current definitions *5 Based on sales performance *6 30-year maturity equivalent *7 As of the end of the fiscal year