Business Foundation

Capital Policy/ERM

Basic capital policy

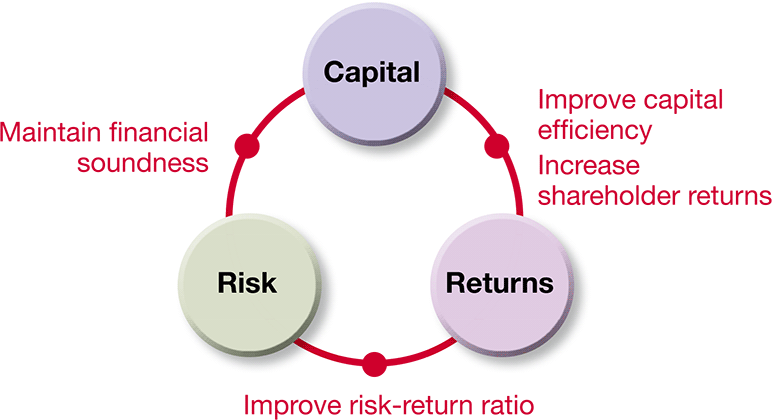

The Company’s capital policy is based on the enterprise risk management (ERM) framework, and its basic capital policy is to appropriately control the balance of capital, risk, and return to achieve a number of goals: maintaining robust financial health; achieving steady improvements in capital efficiency to grow profits to a world-class level and deliver adjusted consolidated ROE of 10% or more; and ensuring attractive shareholder returns (dividends and share buybacks) commensurate with both profit and shareholder equity levels.

Capital Policy Based on ERM Framework

Improving capital efficiency

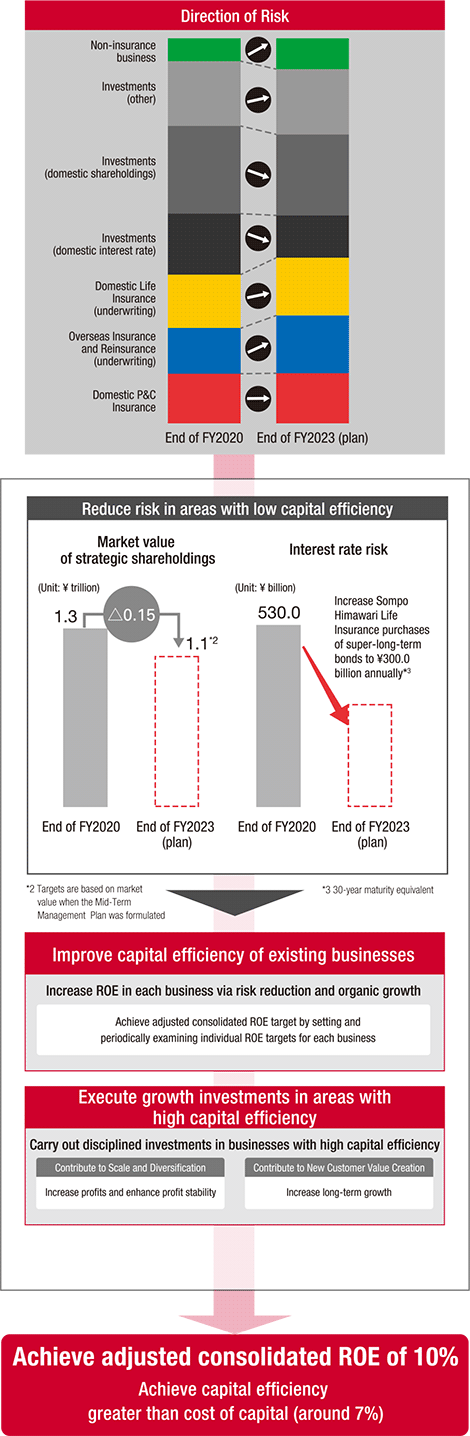

In order to improve the Group’s capital efficiency in a sustained manner, we use both the stable cash flow generated from existing businesses and the capital generated by reducing risk to invest in areas of high capital efficiency, including M&As and other growth investments and digital technologies. With these measures geared towards improving capital efficiency, we aim to achieve a capital efficiency with an adjusted consolidated ROE of 10% or higher and expand Group profit levels over the medium term. We have also established ROE targets for each business and by monitoring the initiatives implemented in each business, we intend to improve capital efficiency and increase adjusted profits for the Group as a whole.

We set our target for adjusted consolidated ROE based both on our capital cost of 7% and on the average level of our global peers, as estimated by the CAPM*1.

*1 The capital asset pricing model (CAPM) is a method used to calculate expected return using the following equation: risk-free rate + beta (sensitivity of our share price to the stock market) × market risk premium

To clearly define the Group’s medium-term risk-taking policy and direction, we have established a risk appetite statement (RAS) as part of the current Mid-Term Management Plan. The RAS outlines our approach to risk taking in each risk category based on return on risks (ROR). Based on the RAS, we are reducing our strategic shareholdings that have low capital efficiency and lowering our exposure to domestic interest rate risks by strengthening ALM. Our initial KPIs for the three-year period of the Mid-Term Management Plan were to sell off roughly ¥50 billion in strategic shareholdings each year and purchase super-long-term bonds to the tune of ¥300 billion annually through the Domestic Life Insurance Business. In fiscal 2021, the first year of the plan, we kept to this schedule by selling strategic shareholdings worth ¥50.1 billion and buying up super-long-term bonds to the value of ¥329.4 billion. In fiscal 2022, however, we stepped up the pace by selling ¥70.3 billion in strategic shareholdings and purchasing super-long-term bonds worth ¥489.3 billion, thus reducing risk at a pace faster than initially planned. We will continue to reduce our strategic shareholdings with the aim of trimming the level back down to less than 20% of adjusted consolidated net assets on a market value basis by fiscal 2030.

Cash flow generated by each business will be used for M&As and other growth investments. Under the current Mid- Term Management Plan, our policy is to allocate management resources worth ¥600 billion to growth investments in the areas of scale and diversification and new value creation, two of the three core strategies in the plan.

For our scale and diversification strategy, we will invest in M&As and organic growth primarily in our Overseas Insurance and Reinsurance Business, with the aim of bettering our chances of achieving our management targets. For our new customer value creation strategy, we intend to invest in creating a Real Data Platform (RDP) and in companies that possess digital and other advanced technologies, as well as in the healthcare domain, with the twin aims of contributing to the resolution of social issues and boosting growth over the medium-to-long term.

We have established a disciplined investment framework when it comes to considering M&As: we assess the consistency of any potential deal with our business strategy, and analyze any expected synergies; we have also set a hurdle rate that takes into account the weighted average cost of capital (WACC) based on financial leverage and the industry characteristics of the acquisition target.

Maintaining financial soundness

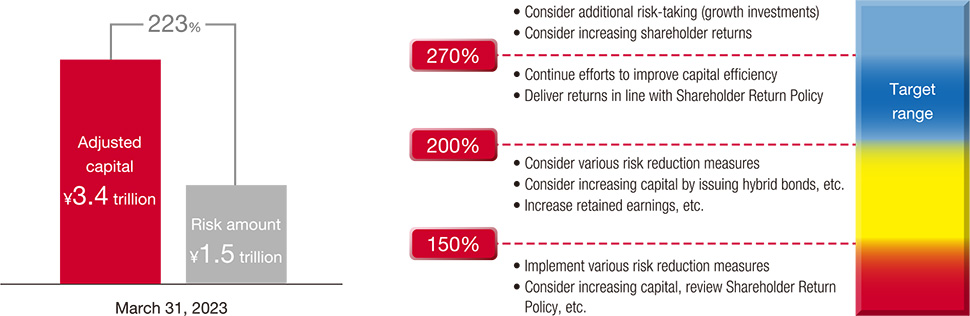

To maintain robust financial health, the Company manages capital based on the economic solvency ratio (ESR), which compares capital and risk based on economic value.

In capital management, we set a target capital level—an ESR of 200% to 270%—and risk tolerance as a guide to appropriate capital levels from the perspective of financial soundness and capital efficiency, and we implement appropriate capital policies according to these ESR target levels. In calculating ESR, we take into account recent regulatory trends and disclosures by domestic and overseas insurance companies. Additionally, in order to enhance global comparability, we have adopted capital management methods that comply with international capital regulations and we are working to maintain financial soundness.

As of March 31, 2023, our ESR level was 223%. This falls within our target range, indicating that our financial health is satisfactory.

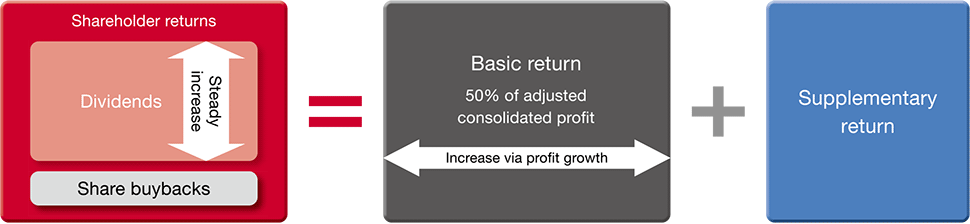

Shareholder returns

The Company aims to provide attractive shareholder returns, in line with a basic policy to continuously increase dividends through sustainable profit growth while taking both its financial soundness and the prevailing business environment into consideration. We also maintain the option of flexibly executing share buybacks depending on share prices and capital availability.

Our shareholder returns policy in the Mid-Term Management Plan is to pay 50% of adjusted consolidated profit as basic return and provide supplementary returns depending on financial results, the financial market environment, and capital availability, among other factors. We intend to steadily increase the total amount of returns (total dividends + share buybacks) through profit growth, raise dividends in line with this growth, and increase the weighting of dividends as a percentage of returns to shareholders. In keeping with this policy, in fiscal 2023 we are forecasting an annual dividend of ¥300 per share (interim dividend of ¥150 and year-end dividend of ¥150). This represents a ¥40 hike from fiscal 2022 and will be the 10th straight year of a dividend increase.

* Supplementary returns will be provided in the following circumstances, depending on risk and capital situations and the future outlook.

Circumstances for supplementary returns include:

- When ESR constantly exceeds the target range

- When it is required to maintain the previous fiscal year’s level of return, in cases where adjusted profit declines due to one-time factors such as natural disasters

- When growth investments such as large-scale M&As are not expected

- When improved capital efficiency, etc., is deemed necessary