Business Foundation

Climate Action

Climate change is a social issue that has wide-ranging impact at the global scale, including the intensification and increased frequency of natural disasters, droughts, and chronically rising sea levels. It threatens the security, safety, and health of people’s lives, and for our Group, whose main business is P&C insurance, it is regarded as posing the risk of significantly affecting our business.

For this reason, the Sompo Group has positioned climate change as a priority challenge to address and has adopted “SOMPO Climate Action” as a principle of its Mid-Term Management Plan to strategically tackle this issue on a groupwide basis.

SOMPO Climate Action

Since the 1990s, the Group has been tackling global environmental issues in collaboration with a wide range of stakeholders. Our strength has been our pioneering environmental initiatives spanning over 30 years, and by combining these with the partnership strategies set forth in our Mid-Term Management Plan, we will implement the three actions of adapting to climate change, mitigating climate change, and contributing to transforming society. Together with stakeholders, we aim to realize an inclusive and resilient carbon neutral society where people and nature are in harmony.

- Contribute to sustainable agriculture via AgriSompo

- Develop products and new businesses for disaster prevention and mitigation

- Provide corporate BCP service

- Use renewable energy across the Group (70% by 2030)

- Engage in sustainable procurement that supports biodiversity

- Develop products and new businesses for the promotion of clean energy

- Establish corporate decarbonization services

- Promote engagement with investee companies

- Proactively participate in rule-making and policy proposals

- Develop environmental personnel

| Four Basic Policies | Specific Initiatives |

|---|---|

| Formulate and Execute a Green Transition Plan | Initiative to achieve interim greenhouse gas (GHG) reduction targets of investee and borrower companies

Contributions through underwriting/investment and loan

* Investee and Borrower Company ESG Policies, please visit our corporate website:Sustainability Vision and Policy |

| Strengthen our Response Systems for Climate Strategies and Risks | Reorganization of the Group Sustainable Management Committee

|

| Enhance our Climate Risk Framework | Building of a new climate risk framework

|

| Respond to Climate-Related Business Opportunities | Promotion of autonomous initiatives for each business

|

Disclosure based on the TCFD recommendations

The following are the Group’s governance, strategies, risk management, and indicators and targets to properly address climate-related risks and opportunities and to aim for the Group’s sustainable growth and enhanced enterprise value.

For detailed disclosure based on the TCFD Recommendations, please refer to our corporate website (Response to Recommendations of the Task Force on Climate-related Financial Disclosures), Annual Securities Report, or Sustainability Report.

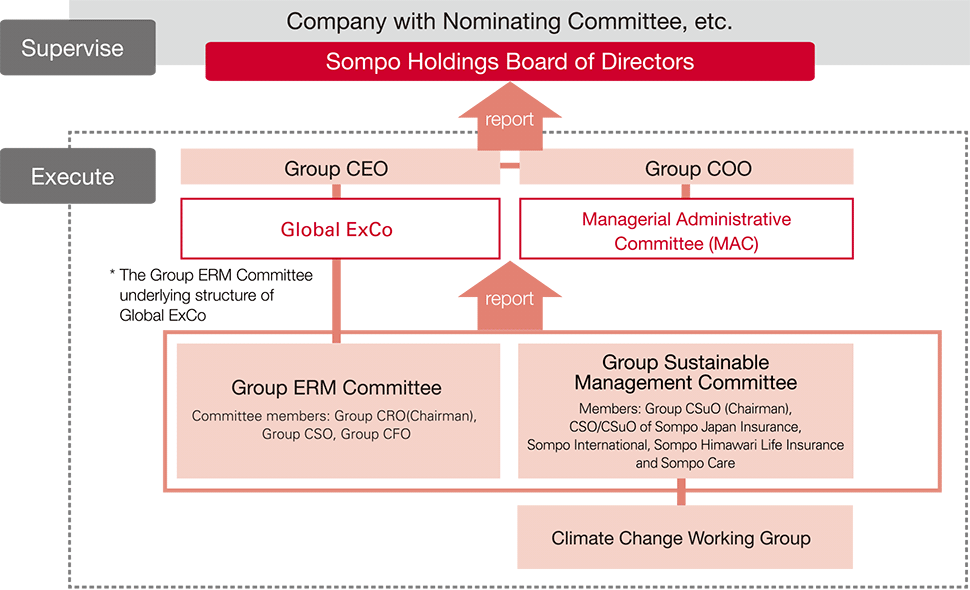

1. Governance

(1) Role of Board of Directors

The Sompo Group has designated “contributing to a green society where the economy, society, and environment are in harmony” as one of its priority issues (Materiality) for realizing SOMPO’s Purpose.

The Board of Directors is responsible for setting groupwide strategies and policies as well as supervising the execution of operations by senior vice presidents and executive officers toward the realization of SOMPO’s Purpose.

(2) Role of senior vice presidents and executive officers

The Group CSuO (Chief Sustainability Officer) is responsible for formulating and implementing sustainable management strategies as the chief executive in the area of sustainability. Regarding climate change and the Group’s sustainable management strategy, by discussing climate change and the Group’s sustainable management strategy as well as how to respond to these issues in light of related risks and opportunities at the Group Sustainable Management Committee, which consists of the CSuO (including the Executive Officer overseeing the sustainability function) and CSO of each Group company, we have established a group-wide sustainability promotion system to support the decision-making of the Group CSuO. In addition, the Sustainable Management Office has been established to support the execution of the Group CSuO’s responsibilities.

Regarding risk management, we have developed a risk control system based on the Sompo Group Basic Policy on ERM established by the Board of Directors, and through the Group ERM Committee, which is a subordinate body of the Global Executive Committee, an advisory body to the Group CEO, the Group CRO (Chief Risk Officer) comprehensively identifies and evaluates risks in each business, designates risks that could have a significant impact on the Group as “material risks,” whereby the status of risk management is periodically reported to the Board of Directors and the Managerial Administrative Committee, which is an advisory body to the Group COO, to verify the effectiveness of the measures, etc.

2. Strategy

In our Mid-Term Management Plan from FY2021, we set forth the “SOMPO Climate Action,” which implements a combined approach to climate change risks and opportunities, and are taking actions to “adapt to climate change,” “mitigate climate change,” and “contribute to transforming society.” For more information, please refer to “SOMPO Climate Action.”

(1) Climate-related risks and opportunities

“Physical risks,” such as the intensification and increased frequency of natural disasters, droughts, and chronically rising sea levels due to the progression of climate change as well as “transition risks,” in which the strengthening of laws and regulations and the development of new technologies toward the transition to a decarbonized society that lead to changes in industrial structures and markets, may affect corporate finances and reputations in various ways and associated liability risks may materialize.

Based on the results of research conducted by external organizations such as the Intergovernmental Panel on Climate Change (IPCC) and the Network for Greening the Financial System (NGFS), we have identified the risks and opportunities posed by climate change to our business and have developed a medium-term (5 to 10 years: approx. 2030) and long-term (10 to 30 years: approx. 2050) timeline for evaluation, analysis, and response.

| Environmental change | Impact on our company | Risk | Opportunities | ||

|---|---|---|---|---|---|

| Physical | Acute | Frequency of typhoons and hurricanes, change in intensity, drought, and increased wildfires | Increased insurance payments due to weather disasters | ● | — |

| Deterioration in the agricultural insurance balance | ● | ● | |||

| Chronic | Sea level rise, increase in average temperature, deforestation, and biodiversity impacts | Increased insurance payments due to flooding caused by rising sea levels | ● | — | |

| A decline in the real estate market (a decline in asset prices) | ● | — | |||

| Political instability and conflict | ● | — | |||

| A new pandemic | ● | — | |||

| Transition | Policy | Promotion of policies related to renewable energy and energy conservation | Price fluctuations of stocks and bonds | ● | ● |

| Higher energy prices | ● | — | |||

| Law | Reparations, changes in laws, and new a legal interpretation | Legal risks such as climate litigation | ● | ● | |

| Technology | Energy storage, renewable energies, and other new technologies | Decarbonization through the spread of new technologies | ● | ● | |

| Market | Investment in and consumer preference for environmentally friendly companies | Reputation | ● | ● | |

| Changes in consumer behavior | ● | ● | |||

(2) Scenario analysis

A. Physical risks

P&C insurance business could be financially affected by higher-than-expected insurance payouts due to the increased severity and frequency of natural disasters, including typhoons, floods, and storm surges. In 2018, we started working with universities and other research institutions to quantitatively grasp risks based on scientific findings. Based on large-scale analysis using weather and climate big data, such as the Database for Policy Decision-making for Future Climate Change (d4PDF), we are working to understand the long-term impacts of a climate with higher average temperatures with respect to changes in the average trends for storm surges affected by typhoons, floods and sea level changes and trends in the occurrence of extreme weather events. We are also analyzing and evaluating the medium-term impact over the next five to ten years and incorporating this information into our business strategies.

We have also estimated the impact related to typhoons using a simple quantitative analysis tool based on guidance issued in January 2021 by the TCFD insurance working group of UNEP FI (United Nations Environment Programme Finance Initiative). We will continue our analysis using the scenario analysis framework being developed by the Network for Greening the Financial System (NGFS), which works on financial regulatory responses to climate change risks.

| Frequency of typhoons | approx. -30% to +30% |

|---|---|

| Amount of damage per typhoon | approx. +10% to +50% |

B. Transition risks

To understand the medium- to long-term impact of the transition to a decarbonized society on our company, we analyzed the impact on our Group’s assets using the Climate Value-at-Risk (CVaR) provided by MSCI for policy risks arising from tighter laws and regulations and global economic changes that will affect companies in the transition to a decarbonized society and technology opportunity arising from climate change mitigation and adaptation initiatives, based on the NGFS scenarios.

In addition, since it is important to encourage companies that have not yet made progress in decarbonization efforts to reduce transition risk, we use the Implied Temperature Rise (ITR) provided by MSCI to quantitatively analyze whether our portfolio companies have set GHG emission reduction targets consistent with the goal of limiting global warming to 2°C by FY2100.

* For the results of the transition risk analysis, please refer to our corporate website (Response to Recommendations of the Task Force on Climate-related Financial Disclosures), Annual Securities Report, or Sustainability Report.

(3) Resilience improvement initiatives

The following are the Group’s key initiatives to increase its resilience to climate change.

A. Responding to risks

| Category | Initiatives |

|---|---|

| Initiatives and Policies for investee companies |

|

| Underwriting Initiatives and Policy |

|

| Our Own GHG Emission Reductions |

|

B. Responding to opportunities

| Category | Initiatives |

|---|---|

| Energy Sources |

|

| Products and Services |

|

| Markets |

|

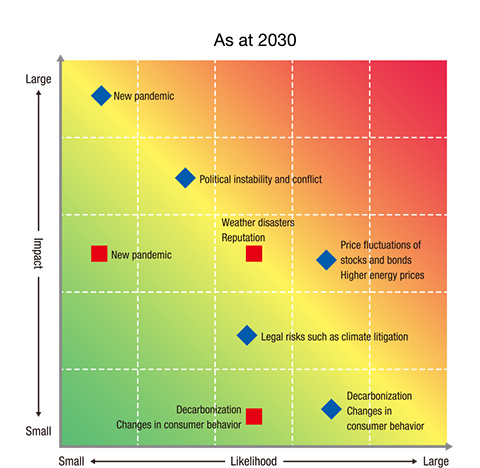

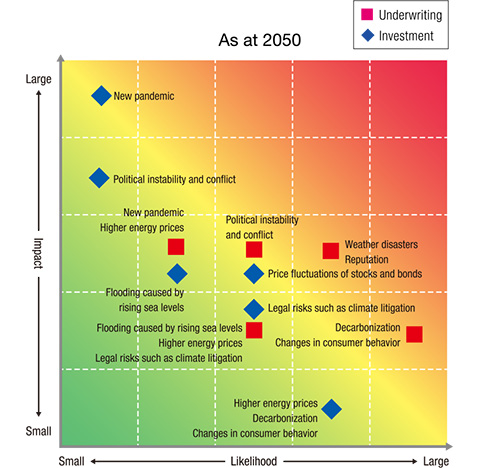

3. Risk Management

Climate change can impact various aspects of the Group’s business, including our non-insurance business, and the impacts are long-term and highly uncertain. To manage climate change risks, including the risks associated with natural disasters, we have developed a climate change risk framework to complement our existing risk control system and to identify, assess, and manage risks by taking an in-depth look at scenarios in which the Group is affected through various pathways in the long-term.

The climate change risk framework “identifies environmental changes,” “discusses their impact on the Group,” and “assesses risks and controls” to capture the complex impacts of climate change.

Based on the assessment results, risks that require continuous monitoring are visualized as “Climate Change Risk Map” to provide a bird’s eye view of the impact, likelihood, timing of occurrence, and trends of risks that primarily affect insurance underwriting and asset management, and thereby stimulating discussions on climate change at the Board of Directors and other executive bodies.

* For more information on the climate change risk framework, please refer to our corporate website (Response to Recommendations of the Task Force on Climate-related Financial Disclosures), Annual Securities Report, or Sustainability Report.

Climate Change Risk Map

Medium-Pattern (SSP 2-4.5/Disorderly)

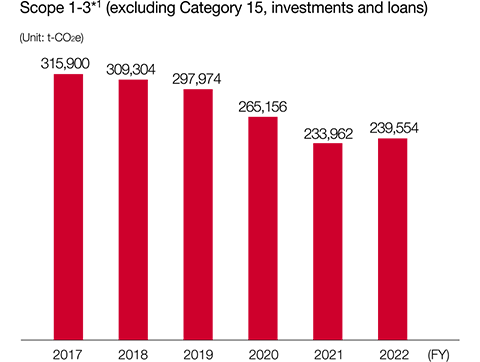

4. Metrics and Targets

(1) Key Metrics

Total GHG emissions

| Unit: t-CO2e/$ US million | ||

| FY | Equities | Bonds |

|---|---|---|

| 2019 | 119.60 | 121.07 |

| 2020 | 100.58 | 133.77 |

| 2021 | 125.05 | 167.04 |

[Third-party verification]

To ensure the reliability of reported figures, Sompo Holdings has received third-party verification from British Standards Institution for its calculations of greenhouse gas emissions (Scope 1–3).

*1 Total Scope 1 (direct emissions from use of gasoline, etc.), Scope 2 (indirect emissions from energy sources, such as electricity), and Scope 3 (indirect emissions across the entire value chain, including transportation, business travel, etc.) GHG emissions. This total covers the emissions of the Company itself and of its key consolidated subsidiaries. Note that emissions for FY2017–FY2021 have been recalculated based on FY2022 calculation methodologies.

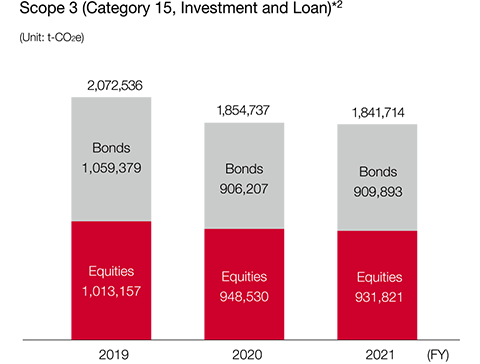

*2 Calculated for Scope 1 and Scope 2 in Japanese and foreign listed stocks and bond investees using data provided by MSCI ESG Research. (coverage of listed stocks is 86% and coverage of corporate bonds is 82%, with both based on market price). GHG emissions are our share of emissions based on investee’s Enterprise Value Including Cash (EVIC), and WACI is the weighted average of each investee’s GHG emissions per unit sales, according to the holding percentage for that investee in our portfolio. Please note that numerical data may be revised retroactively.

*3 The WACI calculation method has changed starting with FY2021 figures.

(2) Key Targets

| Scope 1–3 (excluding Category 15, investments and loans) |

Scope 3 Category 15, investments and loans |

|

|---|---|---|

| 2025 | 25% reduction (compared to 2019 levels) | |

| 2030 | 60% reduction (compared to 2017 levels) | |

| 2050 | Net zero | Net zero |