Strategy

Message from the Group CFO/CSO

Execution of medium-term profitability measures and effective capital policies will drive SOMPO’s growth

Masahiro Hamada

Group CFO/CSO

Progress on management targets

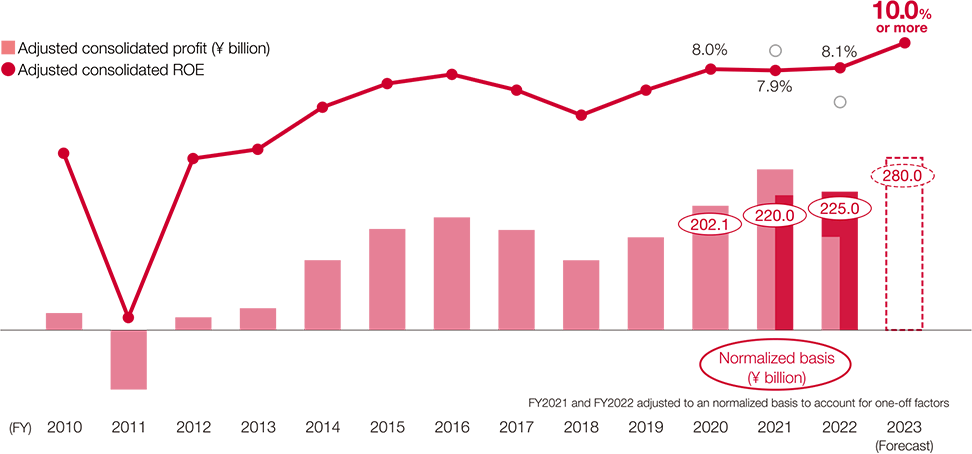

Our Mid-Term Management Plan that kicked off in FY2021 calls for adjusted consolidated profit of more than ¥300 billion and adjusted consolidated ROE of at least 10% as the management targets for FY2023, the final year of the plan. In the last two years, we have made solid progress on the initiatives outlined in the plan, including earnings structure reforms in the Domestic P&C Insurance Business and growth in the Overseas Insurance and Reinsurance Business. This has led to a steady improvement in underlying profitability.

On the other hand, the operating environment, particularly in the Domestic P&C Insurance Business, has changed significantly over the last two years. Specifically, the earnings environment in the Domestic P&C Insurance Business is becoming increasingly challenging mainly because natural disasters are growing more severe and occurring more frequently; margins on fire and allied insurance, including major accidents and the like, have deteriorated; car accidents have increased more than expected after COVID-19; and unit repair costs for voluntary automobile insurance have skyrocketed due to inflation. Taking the impact of these factors firmly into account, we are forecasting adjusted consolidated profit of ¥280 billion in FY2023, just shy of the Mid-Term Management Plan target. However, we expect adjusted consolidated ROE to exceed the 10% target, partly reflecting the impacts of shareholder returns, the reduction of strategic shareholdings, and other capital policy measures.

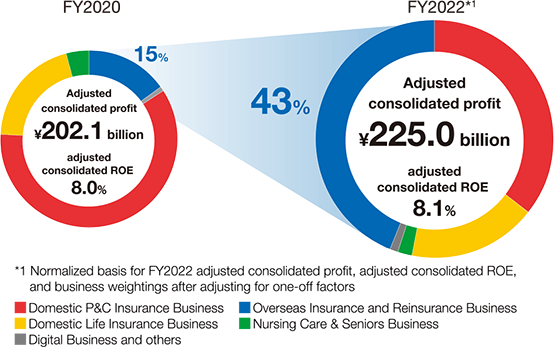

Measures boosting profitability during the MTMP period

Looking back on the first two years of the Mid-Term Management Plan, after stripping out one-off factors such as the increase in COVID-19 hospitalization benefits, FY2022 adjusted consolidated profit on a normalized basis came to ¥225.0 billion, which represents steady growth from the ¥202.1 billion posted in FY2020, the final year of the previous plan. Aided by the tailwind of a rising interest rate environment, we also recorded strong topline growth centering on the Overseas Insurance and Reinsurance Business, thereby achieving Group-wide annualized sales growth of more than 10%. Also, growth in the Overseas Insurance and Reinsurance Business predominantly from rate hikes and bolt-on M&As was the driver of Group-wide adjusted consolidated profit and, as a result, the overseas business weighting in the Group increased by approximately 30% over this two-year period, contributing to the diversification and stabilization of Group profit.

Evolution of each business in Japan

In the Domestic P&C Insurance Business, we have steadily carried out the earnings structure reforms outlined in the Mid-Term Management Plan. Standardizing pricing to match income and expenditures for insurance contracts, strengthening underwriting with the use of Palantir’s data analysis technology, and boosting productivity by improving business processes with the use of digital tools, among other initiatives, have all yielded better-than-expected results.

In the Domestic Life Insurance Business, revenue deteriorated in FY2022 owing to one-off insurance claim payments in connection with COVID-19, but the continued rollout of Insurhealth® products, which combine insurance and health support functions, has led to steady topline growth. As a result, we expect to achieve our Mid-Term Management Plan target for adjusted profit as well.

In the Nursing Care & Seniors Business, we made steady progress on developing “egaku,” our Real Data Platform (RDP). Moreover, we beefed up our external sales structure mainly through the acquisition of ND Software Co., Ltd., a company that holds an industry-leading share of the nursing care software market, and pressed ahead with the development of a business foundation aimed at solving issues in society.

Furthermore, in addition to the steady progress made on initiatives in each business, in FY2022 we launched a new “conglomerate premium” initiative and promoted appropriate risk-taking throughout the Group in order to generate profit through the pursuit of the Group Best concept. The first step was to deploy concrete measures across businesses in the areas of retention & cession, asset management, and multinational. We are forecasting an after-tax profit boost of around ¥15 billion in FY2023 as a result of this initiative.

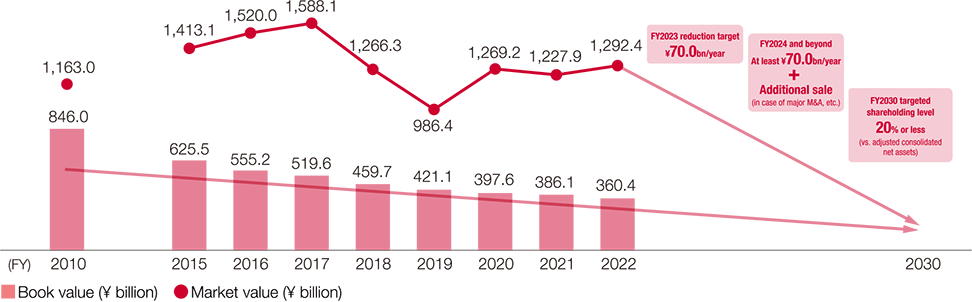

Capital policy during the MTMP period

Even on the capital policy front, we are making steady progress on the objectives of the Mid-Term Management Plan chiefly by minimizing risk in areas characterized by low capital efficiency and allocating capital to growth investments. Particularly regarding the strategic shareholdings of Sompo Japan Insurance, when the Mid-Term Management Plan was formulated, we set a reduction target of ¥50 billion per year (for a cumulative reduction of ¥150 billion over the plan’s three-year period), but with the aim of further improving capital efficiency and generating surplus capital, we ramped up the annual pace of reductions to ¥70 billion starting from FY2022. Our policy in the medium term is to lower the balance of our strategic shareholdings to 20% or less compared to adjusted consolidated net assets by FY2030. However, this target is also a milestone on the way to further reductions in strategic shareholdings and we intend to continue this reduction in FY2030 onwards.

As for interest rate risk, when we formulated the Mid-Term Management Plan, we aimed to have Sompo Himawari Life Insurance purchase super-long-term bonds worth ¥300 billion on an annual basis (for a total of ¥900 billion over the course of the plan), but in light of rising interest rates, we accelerated the pace of its super-long-term bond purchases to ¥489.3 billion in FY2022. As a result, the amount of interest rate risk at the end of FY2022 had been lowered to roughly one third of the level at the start of the Mid-Term Management Plan.

At the same time, ¥600 billion was earmarked for growth investments during the period of the Mid-Term Management Plan. In the first two years, we invested some ¥400 billion to facilitate an increase in capital in the Overseas Insurance and Reinsurance Business and to acquire ND Software in the Nursing Care & Seniors Business. In FY2023 as well, we will continue to seek out investment opportunities that align with our medium- to long-term strategy and make investments at appropriate valuations with a high degree of discipline.

In terms of funds for these growth investments, in 2022 Sompo Japan Insurance issued its first series of straight corporate bonds for the purpose of financing the conglomerate premium initiative. Also, in 2023 we financed the acquisition of ND Software with the Group’s first-ever issuance of ESG social bonds. This marks the first issuance of social bonds by a Japanese insurance group and many of the investors who endorsed our commitment to solving issues expressed their intentions of investing.

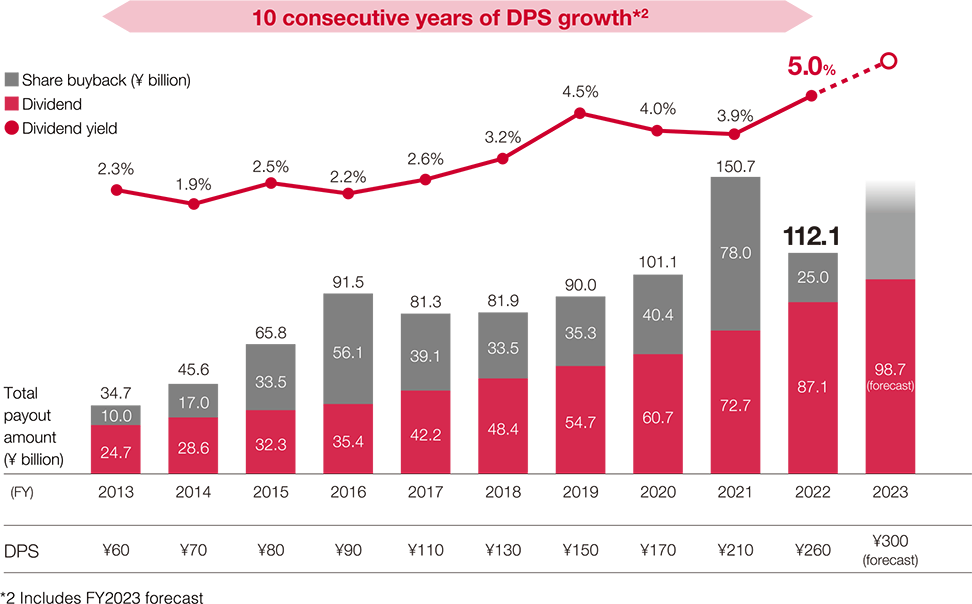

Turning to shareholder returns, we have long aimed to deliver attractive returns to shareholders whilst striking the right balance between improving capital efficiency and our appetite for growth investments. Specifically, 50% of adjusted consolidated profit is currently being paid as basic return. We have also provided supplementary returns in keeping with our transparent shareholder returns policy; in FY2021 we delivered an extra ¥20 billion to shareholders as a way of adjusting our capital levels, and in FY2022 we extended additional returns in order to maintain the previous fiscal year’s level of return when profit declined. We also aim to raise dividends in line with profit growth, which is why we have hiked dividends for 10 consecutive years since FY2014. Plus, we have achieved annualized DPS growth of more than 20% since the start of the current Mid-Term Management Plan.

On the topic of financial soundness, as of the end of FY2022, our economic solvency ratio (ESR)—an economic value-based equity ratio indicator—was 223%, within our target range of 200%–270%. Whilst we continue to invest in growth, there are still no concerns regarding our financial soundness, even though profit has been dented by one-off factors and earnings have been impacted by financial market volatility.

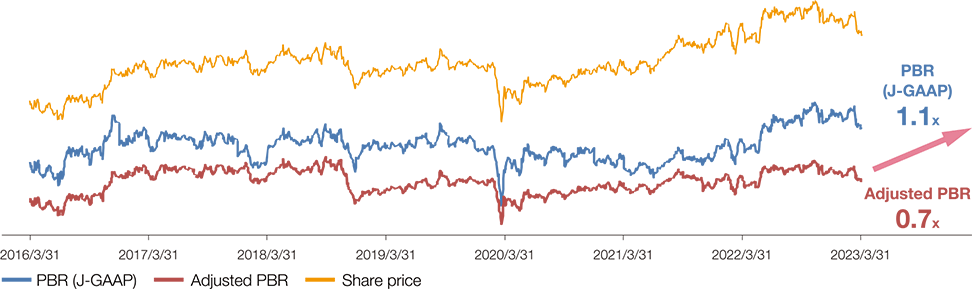

Even despite changes in the external environment weighing on Group profits, we recognize that the steadfast execution of strategic and financial measures in the Mid-Term Management Plan has helped drive the share price to an all-time record high and is contributing to a recovery in the P/B ratio to above 1.0x (J-GAAP basis). On the other hand, the adjusted P/B ratio (which takes into account the impact of Japan’s unique insurance accounting standards) is still currently below 1.0x, so going forward we will aim to get this multiple above 1.0x by further advancing our efforts.

Medium-term management strategy

While FY2023 is the final year of the current Mid-Term Management Plan, it is also the year in which we will formulate the next one. Even though each line of business is steadily growing, we are cognizant of the increasingly challenging business environment. That is why in FY2023, in addition to the current raft of Mid-Term Management Plan initiatives, we started implementing measures to further boost profitability over the medium term.

In our domestic and overseas P&C insurance operations, we will aim to further strengthen our resilience. In Japan, to improve the profitability of fire and allied lines in which margins have deteriorated in particular, we will aim to get earnings back into the black by the mid-2020s through fundamentally improving underwriting conditions with a review focused on not only premium levels, but shorter policy durations and the scope of coverage. Also, to boost productivity, we intend to simplify operations by discontinuing and consolidating products and streamline organizational structures, and improve the persistently high expense ratio to around 31%.

In the Overseas Insurance and Reinsurance Business, as the rate hike cycle that has hitherto supported steady topline growth gradually peaks out, we will look to engage in more profitable underwriting operations and build a diversified underwriting portfolio. We will also invest in geographical expansion with the aim of further stabilizing revenue. We are planning to invest in Canada, Europe, and Southeast Asia in order to diversify away from our existing businesses that are concentrated in the US and the UK.

In the Domestic Life Insurance Business and Nursing Care & Seniors Business, we will use data to generate stronger earnings and create value for society.

For the former, we continue to expand sales of Insurhealth® products, but by analyzing the real data collected from these contracts, we can use it to encourage healthy behavior among customers and propose new services. With this approach, we will aim to generate synergies between stronger sales of insurance and health promotion efforts as a company that supports people’s health.

As for the Nursing Care & Seniors Business, we will press ahead with the full-scale commercialization of the “egaku” project. With the inclusion of synergies with ND Software, which was acquired in 2023, our sights are set on ¥30 billion in sales and ¥10 billion in operating profit by FY2030. Our long-term aim is to become the de facto standard in the industry. We will also endeavor to solve issues in society by filling in the caregiver supply-demand gap.

With these measures for boosting profitability, along with an appropriate capital policy, we aim to drive the share price higher, improve valuations, and enhance corporate value. We attach a lot of importance to improving the P/B ratio as a key benchmark indicator.

Whilst the P/B ratio can be broken down to ROE and the P/E ratio, our domestic and overseas P&C insurance operations in particular are the mainstays of the Group and the driving forces behind ROE improvement as they are strengthening our resilience and maximizing synergies. On the other hand, especially in the Domestic Life Insurance Business and the Nursing Care & Seniors Business, initiatives like “egaku” are indicative of our focus on creating new added value and social value with real data. With this approach, we aim to stoke future growth expectations from investors and lift the P/E ratio.

Furthermore, we will continue to provide attractive returns to shareholders with the aim of realizing an adjusted P/B ratio above 1.0x at the earliest possible time.

We are confident of achieving further growth in the Group’s businesses and enhancing overall corporate value.